What's New at Colonial Parking

We’re Here For You™

Through our commitment to stay at the forefront of best practices, we are a 70-year young leader that never loses sight of our deeply-rooted commitment to provide our clients and customers with the highest level of parking service to be found in metropolitan Washington, DC.

Quick Links

Web design by Jake Group

We are pleased to welcome you as a valued customer of Colonial Parking, Inc.® we offer you the special privileges of becoming a Monthly account holder in return for your agreement to adhere to a few simple guidelines. Please take a moment to become familiar with these guidelines. If you have questions, please feel free to contact our Customer Care Team at (202) 295-8080 or via email [email protected].

-

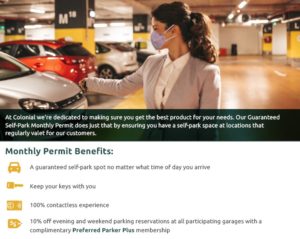

Monthly Parking Permit:

- A regular monthly parking permit guarantees access to the designated parking facility during regular operating hours, but does not guarantee a park-and-lock space. Please call our Customer Care Team for availability and rates for 24-hour access or a reserved park-and-lock space.

- On the FIRST OF THE MONTH during which you are parking, please detach and suspend current monthly permit from your rear view mirror so that the permit month and number are visible through the windshield. A permit displaying a month other than the current one is not valid. Failure to properly display your current permit may result in the assessment of a daily parking ticket, which is non-refundable.

- If you do not display a valid permit, or you have not paid for your current month, you may be issued and charged for a daily parking ticket. You may not exit without paying the daily ticket; and you may not deduct the daily ticket amount from your monthly payment or monthly account balance.

- If you do not receive your upcoming monthly permit by the 25TH OF THE MONTH, or should you misplace it, please call our Customer Care Team immediately. If your account is current, a duplicate permit will be prepared and mailed or made available for you to pick-up. The duplicate permit will void the original. It is your responsibility to notify us of any changes of address or phone number. There may be a nominal fee charged for the generation of duplicate permits. Please note: a request to deliver your parking credential to the facility may take up to 48 hours before delivery.

- If you use more than one vehicle, please transfer your permit from one vehicle to the other, but always display it in the vehicle parked that day. Permit must be displayed whenever the vehicle is in our parking facility. Please note you may park only one vehicle in the garage on a single permit. If a permit is used to admit more than one vehicle at a time; that permit will automatically be deemed invalid and both cars will be towed at the owners risk and expense or assessed the posted daily parking rate.

- Customer may not use monthly parking space for the purpose of vehicle storage.

-

Keycard For Garage Access:

- If you are issued a keycard/transponder/access device for normal or 24-hour access:

- Please keep all electronic access devices in your possession whenever you leave your vehicle; transponders may be detached and removed from the vehicle.

- Please use your keycard/transponder/access device, in combination with your permit (where applicable), to enable the entry/exit of your vehicle only. Any unauthorized use may result in revocation of your parking privileges.

- Please report lost or malfunctioning access devices to our Customer Care Team immediately.

- If you do not have your garage access device at locations where the key card/transponder is mandatory, you will be required to take a daily ticket to enter the facility and to pay for it when you exit.

- There will be a non-refundable replacement fee for a lost keycard, access device or transponder.

- It is your responsibility to return any Colonial issued keycard/transponder/access device upon closure of your account to our corporate office at 1050 Thomas Jefferson Street, NW Suite #100, Washington, DC 20007. Failure to return the access device may result in additional card fees or the denial of device deposit refunds (where applicable).

- Please note: key card and permit (where applicable) are required at all times.

- If you are issued a keycard/transponder/access device for normal or 24-hour access:

-

Parking Guidelines:

- All vehicles parked in the facility must display a valid license plate and be legally registered. Unregistered vehicles may be towed and or ticketed at the owners’ expense.

- Please allow the attendant to park your vehicle when asked, or park it at his/her direction. Please park only in spaces not reserved; your attendant will help you to determine your parking space.

- When required to “leave your key”, please leave ONLY your IGNITION KEY with the attendant (as requested). Failure to leave your ignition key when required may result in your vehicle being towed at your expense.

- Please drive slowly (5 MPH or less) and safely, with your headlights on.

- Where required, garages are equipped with ATTENDANT CALL BUTTONS. Please use the call button to summon an attendant to move another customer’s vehicle or retrieve your key. Please do not approach or enter any vehicles in the facility.

- As a safety precaution, we lock all vehicles left in or on our facilities after the posted closing hour. Please carry a duplicate ignition key. For after-hours assistance call our onsite garage assistance (202) 295-8200. Please note your vehicle may not be retrievable until the facility re-opens the next business day.

-

Payments:

- Invoices and parking credentials for the upcoming month will be mailed only after receipt of the current month payment.

- Parking fees are payable in advance by the 1st day of each month, please remit your payment with the REMITTANCE portion (bottom) of the invoice mailed in the envelope provided or delivered to the address shown on the front of this invoice. Payments received after the 5th of the month will be assessed a late charge, all payments will be required before you receive the next valid parking credential.

- A one-time setup fee of $5.00 will be applied to all new accounts (individual or group).

- A monthly processing fee of $1.75 per account will be charged for individuals and $2.00 per account for groups. These fees are to assist in offsetting a part of the ongoing costs of providing robust parker/group portals and in maintaining data security.

- We apply a $10.00 per payment convenience fee on all check and pay-by-phone payments. We encourage you to enroll in our AutoPay® Program or use our online Customer Care Center to make an electronic payment. (additional information is available online at www.ecolonial.com)

- Please pay the exact amount that is shown on your bill. NO CREDIT can be given for vacation or for partial use of the parking facility. Accounts closed mid-month will not receive a prorated final bill; the full monthly parking fee is payable and due.

- A service charge of $30.00 will be applied for each check returned for insufficient funds. Payments for the returned check charge, plus parking fee must be made by money order, certified check or valid credit card.

-

Account Status:

- Monthly Parking privileges are based on the calendar month. Each monthly cycle begins on the 1st of the month and ends on the final calendar day of the month.

- If you choose to close your account, 30 day notice is required – please:

- Return your UNDETACHED, UNUSED PARKING PERMIT by the 1st of the month, but no later than the 5th to our corporate office at 1050 Thomas Jefferson Street, NW Suite #100, Washington, DC 20007. Use of the permit for ONE (1) DAY, and/or failure to return it by the 5th, constitutes acceptance of the contract for that month; the full rate will be due and payable.

- Return any COLONIAL® ISSUED KEY CARD/TRANSPONDER/ACCESS DEVICE to our corporate office at 1050 Thomas Jefferson Street, NW Suite #100, Washington, DC 20007. We cannot close your account until your keycard has been returned. Use of the access device for ONE (1) DAY, and/or failure to return it by the 5th, constitutes acceptance of the contract for that month.

- We may call you or place a LATE PAYMENT reminder notice on your windshield if we believe your account is DELINQUENT. Please help us resolve the issue by calling our Customer Care Team immediately. We reserve the right to suspend and/or interrupt service on your account if we are unable to resolve the delinquency.

- If your account is SUSPENDED FOR DELINQUENCY, you are required to pay the full outstanding balance due on your account, before service can be reinstated. (there will be no prorate applied to the balance due upon account reinstatement.)

- We may permanently close your account as a result of repeated delinquency (two or more consecutive payments received after the 5th), or for failure to abide by any of the guidelines outlined herein.

- We may elect, at any time with or without cause during a calendar month when your parking privileges are in effect, to notify you in writing of:

- The termination of your parking privileges effective at the end of any calendar month.

- The transfer of your parking privileges to another location within the parking facility or to another parking facility we operate.

-

Damage Claims:

- Colonial makes every effort to return your vehicle in the same condition as it was received. However, should damage occur, each location manager has available Claim Forms which must be filled out before removing the vehicle from the parking premises (failure to do so may result in a denial of your claim).

- Colonial cannot be held responsible for any personal articles (including any keycard or transponder or access device you may have) left anywhere in your vehicle.

- Losses due to freezing or mechanical failure are beyond the scope of Colonial’s responsibility.

- Colonial is not responsible for any loss to the automobile or its contents unless Colonial is directly negligent. Colonial shall not be responsible for such losses that occur during hours when the facility is closed.

-

DC parking tax exemption:

- If you are a resident of the District of Columbia, you may be entitled to DC parking tax exemption. Please inquire at [email protected].

Colonial Parking, inc. reserves the right to update or modify the Monthly Parking guidelines at any time. For the most up-to date Monthly Parking guidelines please visit www.ecolonial.com.

KPMG Employees

We are here to make your transition to a monthly parker as easy as possible. Here is some important information about our application process for KPMG employees.

If you are a KPMG employee, please select the KPMG Regular rate.

If you are a current parker, please add your Nedap Windshield Tag number under the additional information field on the 3rd step of the application. This will help expedite your application.

We will process your application in the order it is received. Your current access will not be interrupted. However, access will be deactivated effective 7/1/2021 for parkers without monthly accounts.

If you are a new KPMG employee and not currently parking, we will allocate a Windshield Tag to you onsite. We will provide you with contact information to coordinate on your welcome email.

Once your application is approved you will receive a welcome email from us with all the information about your new Colonial Parking monthly account.

If you have any questions about your application status, please feel free to contact us at [email protected].

Lot Redirect Popup text goes here

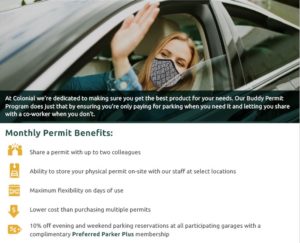

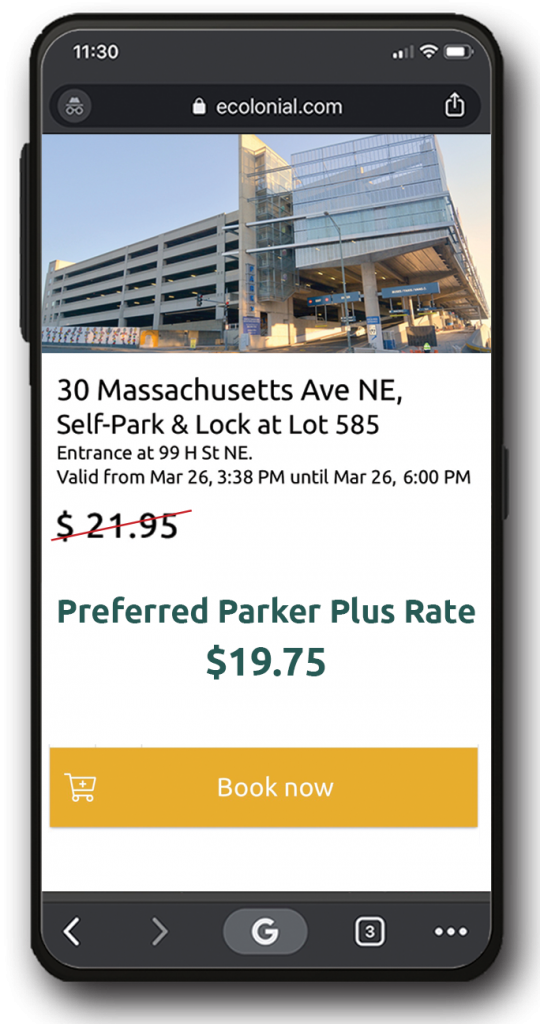

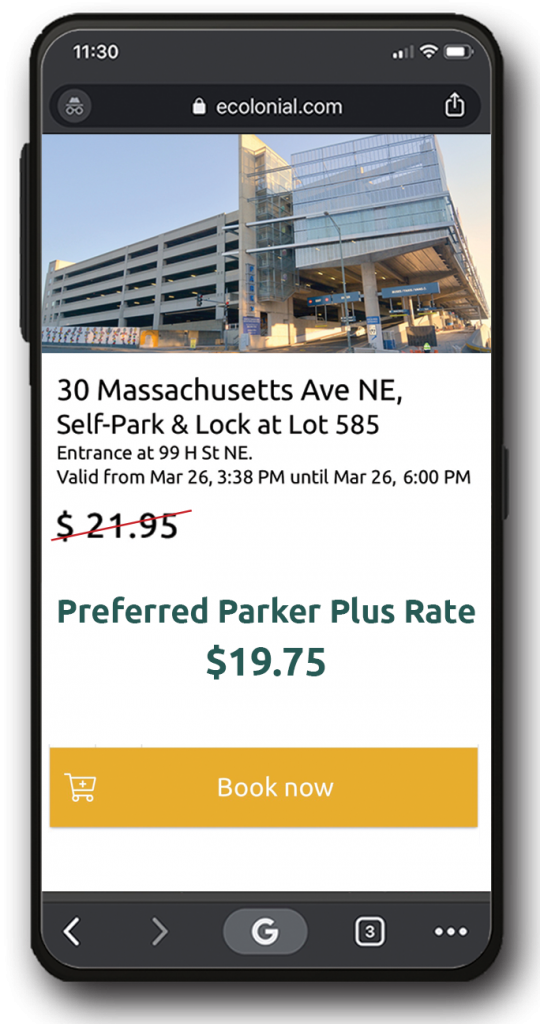

Preferred Parker Plus℠

All monthly accounts now come with a free upgrade to Preferred Parker Plus:

- Colonial’s guaranteed lowest, daily parking rates + 10% off all Evening and Weekend reservations.

- Preferential Parking Inventory.

- Special offers & discounts.

Sign Up for a monthly account to become a Preferred Parker Plus Member.

Already have a monthly account, log in to the Online Customer Care Center to sign up.

Still not convinced? Take a look at our FAQ for more information.

Preferred Parker Plus©

All monthly accounts now come with an free upgrade to Preferred Parker Plus:

- Colonial’s guaranteed lowest, daily parking rates + 10% off all Evening and Weekend reservations.

- Preferential Parking Inventory.

- Special offers & discounts.

Sign Up for a monthly account to become a Preferred Parker Plus Member.

Already have a monthly account, log in to the Online Customer Care Center to sign up.

Still not convinced? Take a look at our FAQ for more information.

I authorize Colonial Parking to charge my monthly parking fee or balance due on the first business day of each month. I understand that I am in full control of my payments, and at any time I may decide to discontinue my AUTOPAY enrollment by providing written notice to Colonial Parking, Inc. via email to [email protected]. I understand I am responsible for notifying Colonial Parking, Inc.® of any status or information changes pertaining to my selected method of payment.

In the event my credit card charge cannot be processed, due to credit limit being exceeded, expiration of card, termination of card, or any other denial reason, I agree to pay the outstanding balance due to Colonial Parking Inc.® within 3 business days to prevent my account from becoming delinquent. I agree it is my responsibility to maintain a valid credit card for payment application. I must provide Colonial Parking Inc. ® with any information necessary required to allow Colonial Parking Inc.® to reinstate my AUTOPAY, if terminated for any reason.

PREFERRED PARKER PLUS

PREFERRED PARKER PLUS

PREFERRED PARKER PLUS